The OBBB (Omnibus Budget and Benefits Bill) and Its HR Impact

$199.00 – $1,999.00

Introduction

The Omnibus Budget and Benefits Bill (OBBB), enacted by President Trump on July 4, 2025, signifies a monumental overhaul across numerous domains—most notably taxes, healthcare, defense, and AI regulation. These sweeping changes will substantially transform human resources functions in organizations nationwide, demanding swift adaptation from HR leaders.

What HR Needs to Know

-

Broad Legislative Reform: OBBB delivers innovative reforms impacting vital HR areas, from employee benefits to payroll and compliance. The scope includes updated tax frameworks, new regulations for healthcare, and shifts in defense and AI policy, all with strong HR implications.

-

Healthcare System Revamp: Provisions within OBBB reshape healthcare accessibility and affordability, compelling HR departments to reconsider how they support employee well-being and coverage.

-

Tax Regulation Adjustments: The bill introduces new tax obligations and reporting standards for individuals and corporations, requiring diligence in payroll systems and financial compliance.

-

Benefits Model Updates: Increased eligibility for HSAs, higher dependent care FSA caps, and new Medicaid work requirements call for strategic adjustments in benefits offerings to ensure both compliance and competitive employee support.

-

AI and State Law Preemption: With federal preemption over state AI laws, organizations must update policy handbooks and employment practices to align with national standards.

Key Areas of HR Focus

-

Benefits Design Modernization: Evaluate and update health and wellness offerings in line with OBBB mandates, ensuring they address the range of employee needs.

-

Payroll & Tax Compliance: Adapt to revised payroll reporting standards, integrating new tax structures to maintain transparency and avoid penalties.

-

Compliance & Policy: Proactively revise handbooks, internal policies, and training to reflect OBBB requirements for health and payroll, and stay ahead of regular regulatory updates.

-

Recruitment & Retention: Enhanced benefits options and evolving work requirements can influence talent attraction and retention—HR must devise new strategies in response.

-

Documentation & Monitoring: Ongoing review and documentation are essential for HR teams to demonstrate compliance and swiftly adapt to any future regulatory adjustments.

Learning Points for HR

-

Comprehend the OBBB’s objectives and strategies to anticipate future HR trends and ensure operational readiness.

-

Stay current with compliance standards and reporting requirements to avoid enforcement actions and foster organizational transparency.

-

Innovate health and welfare programs by leveraging expanded savings accounts and enhanced dependent care benefits.

-

Proactively update policies and communicate changes throughout your organization to facilitate seamless OBBB integration.

Who Should Pay Attention

-

Seasoned HR leaders

-

HR associations and networks

-

Any HR practitioner focused on compliance, benefits, or employee relations

Why Attend OBBB Trainings and Updates?

Attending specialized OBBB sessions equips HR professionals to navigate fresh compliance demands, leverage benefits innovation, and seamlessly integrate new payroll and tax protocols. These insights are essential for protecting your organization and maximizing value for your workforce.

Instructor:

Don Phin has devoted his career to California employment law, beginning in 1983. For nearly two decades, he represented clients in employment and business disputes, ultimately realizing that legal battles rarely produce true winners. Moving beyond the courtroom, Don shifted his focus to sharing knowledge—authoring multiple books and delivering over 500 presentations to executive audiences throughout the country. He is passionate about the power of emotional intelligence in the workplace and is committed to helping leaders build workplaces where people can thrive.

Don created and led HR That Works, a platform adopted by 3,500 organizations, which was later acquired by ThinkHR in 2014. Following the acquisition, he held the role of Vice President for two years.

Now embracing his “wisdom-sharing” phase, Don dedicates his time to mentoring and advising executives, continuing to motivate others through impactful talks, workshops, and executive coaching.

| Session Type |

Live ,Recording ,Transcript ,Live + Recording ,Transcript + Recording ,Live + Transcript ,Bundle for 5 ,Bundle for 10 ,Unlimited Entries ,Bundle for 3 |

|---|

Related products

Mastering Provider-Based Hospital Outpatient Billing & Supervision in 2025

| Session Type |

Live ,Recording ,Transcript ,Live + Recording ,Transcript + Recording ,Live + Transcript |

|---|

Deconstructing Medical Necessity from a Payer Perspective in 2025

| Session Type |

Live + Transcript ,Live ,Recording ,Transcript ,Live + Recording ,Transcript + Recording |

|---|

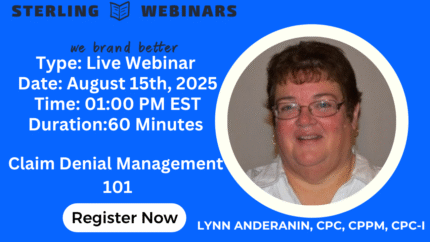

2025 Claim Denial Management 101: Turn Lost Revenue into Practice Profit

| Session Type |

Live ,Recording ,Transcript ,Live + Recording ,Transcript + Recording ,Live + Transcript |

|---|

Reviews

There are no reviews yet.